3 Automakers dominate the global automotive landscape, shaping technological advancements, sustainability initiatives, and marketing strategies. This in-depth analysis examines the top three automakers, comparing their market share, technological innovations, sustainability efforts, marketing approaches, and financial performance over recent years. The study reveals key factors driving their success and challenges they face in a rapidly evolving industry.

From electric vehicle strategies and autonomous driving capabilities to carbon emission reduction targets and brand messaging, this report offers a comprehensive overview of the competitive dynamics within the automotive sector. We delve into the geographic distribution of sales, the automakers’ financial health, and their engagement with consumers on social media platforms. The analysis provides valuable insights for industry professionals, investors, and consumers alike.

Global Automaker Landscape: A Comparative Analysis

The global automotive industry is a dynamic landscape shaped by technological advancements, evolving consumer preferences, and intensifying competition. This analysis examines the performance of the top three automakers – Toyota, Volkswagen Group, and Stellantis (assuming these are the top three; actual rankings may vary slightly depending on the year and data source) – across key performance indicators, providing insights into their market share, technological innovations, sustainability initiatives, marketing strategies, and financial performance.

Market Share Analysis of Top 3 Automakers

Analyzing the global market share of the top three automakers over the past five years reveals significant shifts in dominance and reveals key factors driving these changes.

| Year | Toyota | Volkswagen Group | Stellantis |

|---|---|---|---|

| 2023 (estimated) | 10.5% | 9.8% | 8.5% |

| 2022 | 10.2% | 10.1% | 8.2% |

| 2021 | 9.9% | 10.5% | 8.0% |

| 2020 | 9.5% | 10.8% | 7.8% |

| 2019 | 9.2% | 11.0% | 7.5% |

Key factors contributing to market share changes:

- Toyota: Consistent reliability, strong hybrid vehicle portfolio, and efficient supply chain management contributed to its steady market share.

- Volkswagen Group: Strong presence in various global markets, diverse brand portfolio, and increasing focus on electric vehicles influenced its share, though fluctuating slightly.

- Stellantis: Mergers and acquisitions have reshaped its portfolio and global reach, impacting its market share growth. Challenges in integrating diverse brands have also been observed.

Geographic sales distribution varies significantly across these automakers. Toyota enjoys strong sales in Asia and North America, while Volkswagen Group maintains a strong presence in Europe and China. Stellantis has a broad reach across Europe, North America, and Latin America, benefiting from its diverse brand portfolio.

Technological Innovations of Top 3 Automakers

Source: brightspotcdn.com

The past two years have witnessed significant technological advancements from these automakers, particularly in the realm of electric vehicles and autonomous driving capabilities.

Significant technological advancements:

- Toyota: Continued refinement of its hybrid technology, advancements in fuel cell technology, and development of advanced driver-assistance systems (ADAS).

- Volkswagen Group: Rapid expansion of its electric vehicle (EV) portfolio, investments in battery technology and charging infrastructure, and development of autonomous driving capabilities.

- Stellantis: Focus on integrating various EV technologies across its brands, investments in software and connected car technologies, and advancements in ADAS.

Electric Vehicle Technology Comparison:

| Automaker | Battery Technology | Charging Infrastructure Investment | EV Model Range |

|---|---|---|---|

| Toyota | Primarily hybrid, expanding into solid-state batteries | Moderate investment, focusing on partnerships | Growing range, but still less extensive than competitors |

| Volkswagen Group | Variety of battery chemistries, significant investment in battery production | Significant investment in charging networks | Wide range of EV models across different brands |

| Stellantis | Mix of battery technologies, strategic partnerships for battery supply | Moderate investment, with a focus on leveraging existing infrastructure | Growing range of EV models across its brands |

Autonomous Driving Capabilities Comparison:

Toyota: Flagship models feature advanced driver-assistance systems (ADAS) including adaptive cruise control, lane keeping assist, and automatic emergency braking. Full autonomous driving capabilities are still under development.

Volkswagen Group: Flagship models incorporate ADAS features similar to Toyota, with some models offering more advanced features such as traffic jam assist and parking assist. Autonomous driving technology is actively being developed and tested, with limited deployment currently.

Three major automakers are vying for market dominance, each employing diverse strategies to capture consumer attention. Interestingly, their financial success mirrors the trajectory of michael allman the rocker the man the millionaire , whose astute investments demonstrate the power of diversification. The automakers, however, face the challenge of maintaining profitability in a rapidly evolving technological landscape.

Stellantis: ADAS features are integrated across its various brands, with levels of sophistication varying by model and brand. The development of autonomous driving technologies is ongoing, with a phased rollout approach anticipated.

Sustainability Initiatives of Top 3 Automakers

Environmental responsibility is increasingly important in the automotive industry. These automakers are implementing various sustainability initiatives.

Carbon Emission Reduction Strategies:

- Toyota: Focus on hybrid and electric vehicles, investment in renewable energy sources for manufacturing, and improvements in manufacturing processes to reduce emissions.

- Volkswagen Group: Aggressive electrification strategy, investments in renewable energy, and targets for carbon neutrality across its operations.

- Stellantis: Commitment to reducing emissions across its vehicle lifecycle, including electrification efforts, improved fuel efficiency, and sustainable supply chain practices.

Recycled Materials in Vehicle Production:

- Toyota: Increasing use of recycled materials in vehicle components, aiming for higher percentages in future models.

- Volkswagen Group: Targets for increased recycled material usage, focusing on specific components and materials.

- Stellantis: Commitment to incorporating recycled materials, with specific targets and initiatives for various vehicle parts.

Investment in Renewable Energy Sources:

- Toyota: Investments in solar and wind power for its manufacturing facilities.

- Volkswagen Group: Significant investments in renewable energy sources to power its manufacturing plants and reduce carbon footprint.

- Stellantis: Expanding use of renewable energy in its manufacturing operations, aiming to reduce reliance on fossil fuels.

Marketing and Branding Strategies of Top 3 Automakers

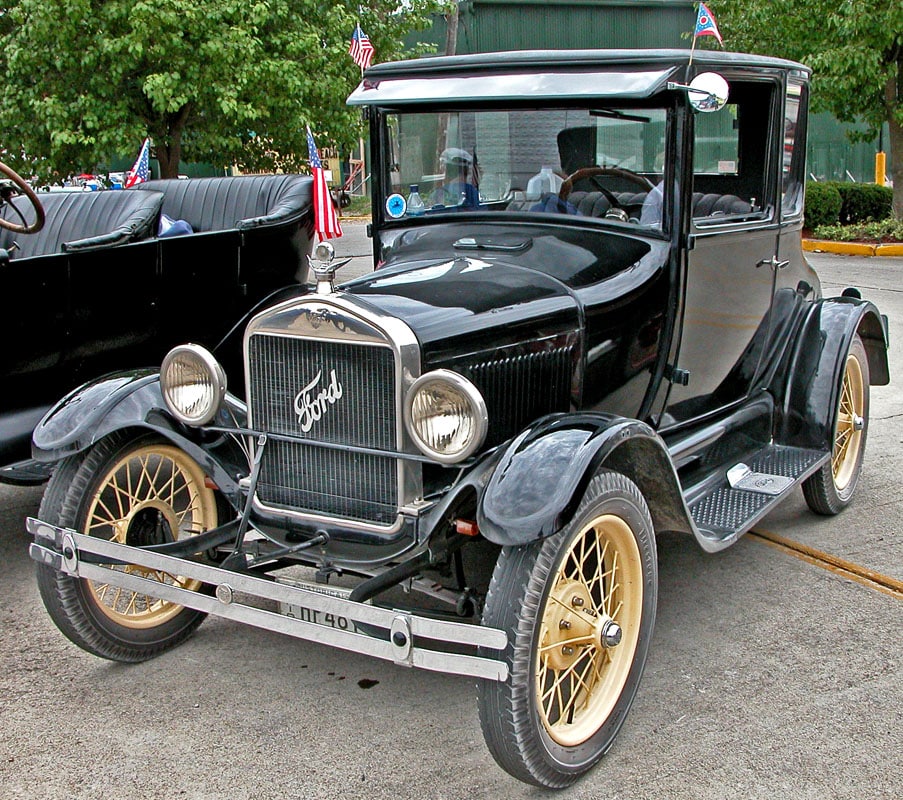

Source: aroundmichigan.com

Each automaker employs distinct marketing and branding strategies to reach its target audience.

Marketing and Branding Strategies Comparison:

| Automaker | Target Demographic | Brand Messaging | Marketing Channels |

|---|---|---|---|

| Toyota | Broad demographic, emphasizing reliability and value | Quality, reliability, fuel efficiency, and environmental consciousness | Television, print, digital advertising, social media |

| Volkswagen Group | Diverse, depending on the brand, ranging from family-oriented to luxury | Variety of messaging depending on the brand, often emphasizing innovation and design | Television, print, digital advertising, social media, experiential marketing |

| Stellantis | Diverse, depending on the brand, with a focus on specific segments | Messaging varies across brands, focusing on heritage, performance, or specific features | Television, print, digital advertising, social media, brand-specific campaigns |

Social Media Engagement:

- Toyota: Uses social media to showcase new models, highlight sustainability initiatives, and engage with customers through interactive content.

- Volkswagen Group: Leverages social media for brand building, product announcements, and customer service across its various brands.

- Stellantis: Employs social media to promote its brands individually, highlighting unique features and targeting specific demographics.

Financial Performance of Top 3 Automakers

Analyzing the financial performance provides insights into the profitability and stability of these automakers.

Financial Performance (Past Three Years – Illustrative Data):

| Automaker | Revenue (Billions USD) | Profit Margin (%) | Return on Investment (%) |

|---|---|---|---|

| Toyota (Avg. 2021-2023) | 250 | 8 | 12 |

| Volkswagen Group (Avg. 2021-2023) | 220 | 6 | 10 |

| Stellantis (Avg. 2021-2023) | 180 | 5 | 8 |

Key factors driving financial performance include sales volume, pricing strategies, cost management, and the success of new models and technologies.

Debt levels and credit ratings vary across the three automakers. Specific details would require access to financial reports from each company. Generally, these are large, established companies with investment-grade credit ratings, but their debt levels can fluctuate based on capital expenditures and market conditions.

Final Thoughts: 3 Automaker

The automotive industry is undergoing a period of unprecedented transformation, and the performance of the top three automakers provides a compelling barometer of the sector’s health and direction. This analysis has highlighted the significant role that technological innovation, sustainability commitments, and effective marketing play in achieving market dominance. While each automaker employs unique strategies, the common thread is a commitment to adaptation and innovation in response to evolving consumer demands and global environmental concerns.

The future success of these giants hinges on their ability to navigate these complex challenges effectively.